Property Investor Secretes To Get Highest ROI

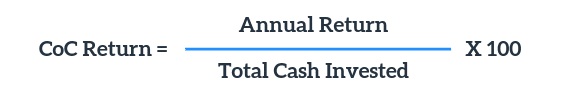

Real estate ROI, as we all know, is a tool for evaluating the performance of investment assets. It's basically the profit a real estate investor can make in relation to the amount of money he or she invested in the first place. According to this definition, the ROI formula is as follows:Real estate ROI, as we all know, is a tool for evaluating the performance of investment assets. It's basically the profit a real estate investor can make in relation to the amount of money he or she invested in the first place. According to this definition, the ROI formula is as follows:

If you're one of the fortunate real estate investors who has enough cash to buy and own an income property outright, you can use the cap rate formula to calculate your ROI. In real estate, the cap rate is a return on investment measure that determines how much income is generated in relation to the cost of the investment property.

Well, when it comes to what is a good ROI for cash investments in real estate, experts suggest that anything from 4% to 10% is a good cap rate.

The majority of real estate investors are known to fund their investment properties with a mortgage loan. This choice is common not only because it allows them to spend less of their own money, but also because it serves as leverage to obtain a high return on investment.

Get the Highest Return on Investment Property

1. Improve Your Real Estate Knowledge

You must be aware of these factors and know how to take advantage of them in order to make good real estate investments. For example, you should be aware of the best investment property financing process, the best rental strategy, the best investment property type, and the best locations to conduct your investment property quest.

2. Seek Guidance from Experts

This contains working with a good real estate agent and having mentors. Learning from those who have experience in the field can help you find profitable income properties more easily. You will be able to avoid pitfalls that could adversely affect your return on investment.

3. Don’t Involve Your Emotions

During your property search for income assets with the highest return on investment, you must set your emotions aside. Instead of listening to your heart, consider investment opportunities logically. You shouldn't, for example, buy an investment property just because you like the trees and greenery in the area. While this is appropriate when purchasing a primary home, it may not have the best monthly return on investment. An income property is more than just a pretty face. You should consider the numbers when looking for the best return on investment.

4. Use Real Estate Investment Tools

You'll need to look at a lot of different real estate listings to find the best investment property. Not every property for sale would have a good return on investment. However, manually analysing a large number of possible investment properties would take a significant amount of time and effort. Investors may use a variety of online real estate investment tools to quickly and reliably locate investment assets with the best return on investment.